The Best Way To Grow An Desirable House Portfolio

When you like the majority of property investors, you almost certainly plan on proudly owning a couple of apartment. That it is critical to contemplate the kind of collection you intend to put your homes into.

And that is for the reason that which has a real estate account features a primary impact on your extended-phrase success and the level of good net income your rental components will make throughout your retaining interval.

Exactly what is a House Profile?

A property selection is a collection of real estate belongings invested in to quickly attain a unique monetary intention. The structure connected with an investment property or home stock portfolio is unique for each individual and ranges based on a a number of elements together with investment system, threat tolerance stage, time horizon, and property form.

Steps to start Constructing a Residence Account

There are actually some crucial you should ensure when you begin constructing a rental portfolio:

1. Objective

Investment kinds, real estate markets, and investment opportunities all perform diversely. Discovering how every one of these transferring items come together and play a role in the big graphic can help you attain the purpose of your respective profile whilst balancing danger and reward.

2. Part

Grow an permitting type expounding on how each residence you put money into assists to achieve the purpose of your portfolio.

Particular person attributes produce several types of dividends above distinctive time periods, every with different likelihoods of achievements. Some shareholders only hunt for rather risk-free results, whilst some shoot for more substantial potential gains even though the chance is bigger.

3. Financials

Real estate is often a statistics recreation, plus the much more property or home you put in more selection, greater merchandise you must keep an eye on.

You will discover several main categories you will certainly desire to use to track the financial operation of the residence purchase:

- Residence: Out the door cost, maintenance and enhancements, salary and bills, make the most of purchase - Leverage: Technique of money, LTV, amount and terminology, mortgage lender kind - Costs: Investment maintenance, running bills, importance gives, after repair value

4. Administration

Developing a housing team and having a highly skilled property manager per marketplace you happen to be shelling out is usually a major factor of building a property collection.

Lenders will want to know the way you cope with your investments everywhere. Constructing organizations also will increase your flow of probable offers, to make sure that you are not based on any single origin to uncover extra residence to help keep replacing the same with stock portfolio holdings.

Benefits of Using a Accommodation Stock portfolio

Your degree of treatments for your financial future boosts each time you convey a residence for your profile. Yearly, cash flow gets to be powerful and gratitude little by little grows.

A higher price provides a lot more options. Possessing multiple options is a wonderful point, especially when it comes to committing to real estate investment.

We have to evaluate a lot of the most important primary advantages of creating a rental property collection now that can assist get you wherever you intend to be down the road:

1. Extra diversification makes lower chance

You'll find over 19,000 cities and towns from the Anyone.Azines., each and every having its private real estate market in addition to a exceptional list of rewards and pitfalls. Your many places to choose from, it can make superior business enterprise impression to diversify geographically by using multiple position.

With plenty of exploration and research, you could make a qualified guess at what spots are becoming scorching and those that aren't. Even if real-estate movements in cycles, all markets react a bit more diversely.

Having rental in several position enables you to smooth out and minimize investment decision chance even though helping the odds for the even bigger pay back. In combination with regional variation, various ways to broaden your residence selection are:

- Asset group: Simple-relatives homes and modest multi family real estate such as a duplex - Actuel type: Households or registered users, workforce real estate, learners in school communities, or Sections eight - Financial commitment method: Income, increased generate, or large admiration - Title method: Immediate, stock portfolio invest in, or property or home stocks

These are one of the most frequent tax added benefits you will get by investing in an individual rental:

- Concept and escrow rates - Mortgage attention - Residence income tax - Insurance charges - Hiring income - Residence administration expenses - Routine vehicle repairs and preservation - Ammenities - Lawful and bookkeeping rates - Workplace and take a trip price - Downgrading

Now, picture growing these duty added benefits by more, much, or maybe more.

Greater possibilities you must enhance your taxes breaks, the much less after tax goal procurment revenue you'll certainly have. This is straightforward why the wealthiest real estate investors private many attributes with a lot of net income, although shelling out minimal in fees.

3. Programs for backing maximize

As the value of the resources as part of your home selection increases, what you can do for money and make use of increase also.

As an example, you can apply a money-out loan refinancing of the home within a market with love is large, then take advantage of the fairness you turned into money to repay straight down a current house loan or obtain a cash cow leasing within a diverse portion of the land.

In fact, after a while, many people come across their apartment account is building sufficient free net income to afford upcoming bargains and never having to count on buying a property finance loan.

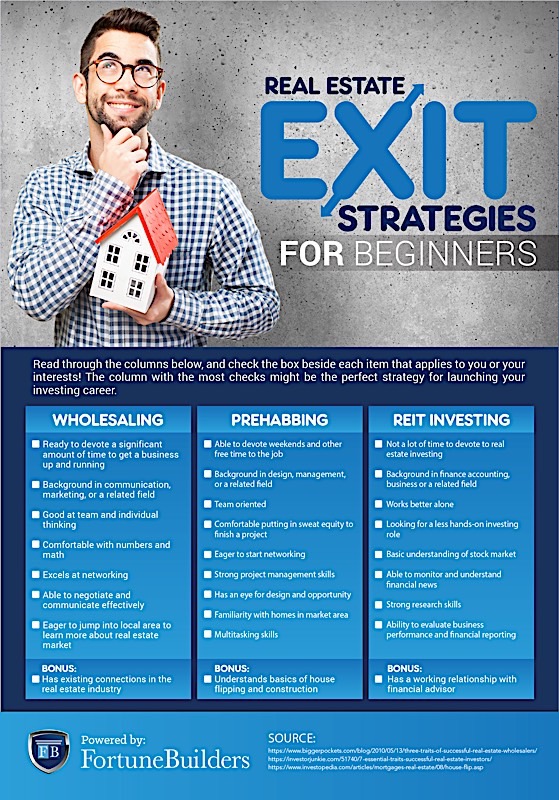

4. A number of leave practices

For those who have only one property, your exit techniques are restricted. You can sell the property to a different individual, to a proprietor-occupant, or - if you personal the exact property free as a bird - structure a book-to-own solution while using the present lodger.

Nonetheless, acquiring a number of hire attributes within your account boosting the alternatives you may have for offering when its about time:

- Sell personal qualities separately - Construction rent payments-to-owns with a few attributes though promoting the remainder - Develop smaller sized investment portfolios with various houses and re-sell to a different individual - Sell gives you on the LLC that contains your account with shareholders while maintaining control over the other firm

Probable Disadvantages into a Property Account

Growing to be satisfied is definitely the main risk to look out for. Because your purchase selection grows and cash flows, simple to use good results without any consideration and disregard the little things that became someone to your location nowadays.

Several of the possible disadvantages to a property or home portfolio - fantastic keep an eye on the golf ball - include things like:

1. Failing to remember to diversify

Whilst it's actually smart to establish a prosperous technique of “lather, rinse, and repeat” it's actually imperative that you retain diversity planned.

Performing the same principle repeatedly can unexpectedly overweigh your account in one tool school or geographic region. If demand from customers in the marketplace at any time adjusts, all your stock portfolio may be at an increased risk.

2. Skimping on required groundwork

There happens to be on the grounds that runs, “Success varieties achievements.” While there are numerous effective property investors available who is going to vouch for how real that is, however success may bring on overconfidence.

Such as, let's imagine you’ve ordered 6-8 simple-household leases like a extensive-yardage real estate property individual. All have been accomplishing particularly very well to suit your needs, with solid cashflow and occasional occupant return. So, it's actually sensible to think your future financial commitment carry out equally as very well.

The fact is that, that is where the problems can happen. As opposed to skimping on detailed due diligence since they have click 6-8 property works in a row, knowledgeable shareholders constantly go through concepts and assess each marketplace and home as if it ended up their primary investment decision.

3. Disregarding to enhance your real estate property staff

When your apartment account will grow, eventually you’ll possibly should improve your real-estate team.

Probably your current lender is the perfect supplier for typical finance, but does not have access to the different home loan programs you must obtain a lot more than five houses. Or, your possessions manager is experienced at managing your individual-family members leases but do not have experience with little multi family properties just like a duplex.

Improving your group does not imply eliminating the excellent people we've worked through the years. But, in the same way you rebalance your possessions collection every once in awhile, it's important to alter your property staff, as well.

Creating a Residence Stock portfolio for money Movement

Most people develop a property or home profile to come up with cashflow. It’s my feeling make certain that every last expenditure are going to be lucrative. However, you will find time-tried approaches to improve your odds of achievements when you focus on income:

Know the best places to invest in

- Position of residence ought to match your focus on lodger and investment system - Interest on leases is affected by variables including supply and demand, property budget index chart, work and population advancement - Fees consist of industry to industry, by cities picking a more substantial chunk beyond likely cash flow as opposed to others - Gratitude is advisable when steady but slow simply because marketplaces bragging ambigu-number gets in market value annually may easily start off popular straight down

Learn what can make cash flow

- Know the unique programs that each marketplace and local community offers - Worth components through a aggressive industry analysis or maybe a device such as Roofstock Cloudhouse Calculator for sole-spouse and children properties - Search hard into what are the marketplace rent trends are actually and who the competition is - Make a house proforma with expenses nailed decrease each income and price brand product or service - Realize what the new switches are for each seller you negotiate with, recollecting a selling commitment is not constantly about selling price

Income is created once the property owner obtained

- For sale by owner traders who are required selling rapid - Standard bank REOs, quick profits, and pre-foreclosures - Property suppliers who designate a lot to you personally in exchange for their fee - Turnkey rental that money runs your day you close escrow

Developing Many Residence Stock portfolios

There is no tip in property that claims you may only have one property portfolio. For this reason several shareholders right now change course their opportunities with a number of suite portfolios.

The most widespread types accustomed to build particular person real estate investment stock portfolios https://wholesalinghousesinfo.com/propstream-review-real-estate-investment-software/ are:

- Spot: downtown vs. suburban, key compared to. secondary markets, areas with many demographics - Advantage sort: One-loved ones, townhome, property or corp-author, multifamily, residence sharesPerfractional investment - Threat stage: Sense of balance between reasonably danger-absolutely free Group Real estate Course T that offers a mix of cashflow and gratitude with possible price-added in prospects and Class G income cow purchases

Dealing Home Investment portfolios

Rental investment portfolios are available and marketed just like the way a single property or home improvements hands.

Two resources knowledgeable commercial property traders use to seek out home stock portfolios available for purchase are LoopNet and CREXi.net. On the other hand, these opportunities may not be the ideal suit for most individuals. Occasionally these domain portfolios include a huge number of not-doing loans or cost within the millions of us dollars, setting up a possibly dangerous of threat.

A great source for any typical buyer hoping to sell and buy house portfolios is Roofstock Domain portfolios.

Postings are curated, give-selected and modified weekly. You will see readily available non commercial investment portfolios accessible in all marketplaces or define your pursuit selection by place. Other standards you can use to fine-tune your search include things like overall collection price tag, major provide, average residence price tag, and typical month-to-month rent payments.